![]() This is such an exciting time to be alive. At any moment, the world may end, our country may crumble, the dollar becomes more worthless…BUT, creating wealth has never been simpler in the history of mankind thanks to the internet. Let’s talk about TRUE passive income, something I’m extremely passionate about building for myself and others. What is passive income? Well it’s basically money you can make without much or any labor at all expended. Rental properties tend to be the first thought of passive income, but these can come with risks and of course having to deal with PEOPLE.

This is such an exciting time to be alive. At any moment, the world may end, our country may crumble, the dollar becomes more worthless…BUT, creating wealth has never been simpler in the history of mankind thanks to the internet. Let’s talk about TRUE passive income, something I’m extremely passionate about building for myself and others. What is passive income? Well it’s basically money you can make without much or any labor at all expended. Rental properties tend to be the first thought of passive income, but these can come with risks and of course having to deal with PEOPLE.

Crypto. Did you just roll your eyes or clench your butt cheeks a little because it’s scary and new? Well it is the pure definition of passive income in this day and age and it’s helping to create generational wealth for regular folks that you probably know. I got involved just about a year ago now and I’ve seen my portfolio at it’s low at 12% up and at it’s current high of 180% up. This is real money and I started investing $5-25 bucks at a time.

Today I want to help teach you guys a little more about the basics of crypto with a little help from my buddy. I’d like to introduce a very good friend of mine, we go way back to high school…Jim Hyatt. Jim and I are going to talk a little about something we’re both very passionate about…cryptocurrencies! Jim digs even deeper and has been involved for years longer than I have. He’s agreed to help folks get started with understanding the basics of crypto, why you should invest, the real world possibilities and potential dangers of investing, when the “right” time to get started, and how to get started.

![]() Hey Nick, I’m glad we are finally able to connect with our schedules to have this discussion on crypto. For those who don’t know, Nick and I went to high school together and have become good friends since we graduated. As far as my personal background – I spent 16+ years in law enforcement and I have recently joined a friend in a business venture which is going very well.

Hey Nick, I’m glad we are finally able to connect with our schedules to have this discussion on crypto. For those who don’t know, Nick and I went to high school together and have become good friends since we graduated. As far as my personal background – I spent 16+ years in law enforcement and I have recently joined a friend in a business venture which is going very well.

Like many other people, crypto (specifically Bitcoin) was just background noise that I would occasionally hear about in the news from the early 2010’s. I would hear rumblings about how some person became very wealthy by owning this magic internet money but I never really took any time to understand it. Truth be told, if I would have spent the same amount of time learning about crypto as I did researching fantasy football I would be a very wealthy man (albeit probably missing a couple fantasy championship rings).

In late 2017 I was involved in a car accident at work which resulted in my being home for several months. During that time I had quite a bit of free time while my kids were at school and this was right when crypto was on fire late 2017 early 2018. I wasn’t invested but I had the time to learn.

I made my first crypto purchase in August of 2018 after really diving into one particular cryptocurrency, XRP, and became enamored with the use case and potential of it. I think my first purchase was about $1,000 worth of Bitcoin which I then used to purchase XRP. Back then it was still set up to where you needed to buy Bitcoin on Coinbase, send the Bitcoin to Binance, and then buy XRP on Binance with the Bitcoin. It was confusing, scary, and a bit ridiculous compared to how easy it is now.

Since then I’ve been researching and learning every day about the whole crypto space and I am invested in many different projects with many different use cases. Crypto has become a passion of mine and I really believe it is going to have a profound effect in society and become ingrained in our everyday life to the point where we will look back and wonder how we ever functioned without it.

How much would $1000 invested in Bitcoin in August 2018 be worth today?

Absolutely my friend, when I learned how into crypto you were, it made perfect sense to skip talking about fantasy football for a little bit and see if we can’t help create some wealth for other folks like we’ve both seen in the crypto world. Funny that you mention fantasy football and the amount of time we used to spend on that. I think so much of that was we both saw it as an opportunity to make some extra money. At the time working at Paige Group and the tv station, winning a few hundred bucks in fantasy was game changing. Now we’re waking up to look at crypto gains, some days in the hundreds and thousands.

![]() I think you’ve honed in on the biggest hurdle for most people regarding crypto and that is the propensity to just write it off as a fad or something foolish that people are throwing their money into. The biggest detractor for people in my experience seems to be they have a hard time grasping the “well what is it though” as if they want it to be something tangible – something they can physically hold. My response usually goes something like this… “Do you get direct deposit? Do you pay your bills online? Do you buy stuff from Amazon? At any point during those transactions do you physically hold that currency that you receive/spend? No? Well how is that digital form of money any different than crypto currency?” At that point I typically see the light bulbs kind of go on. With crypto if your question is “ok how can I turn this into real money”… well the option to turn it into the US dollar is always there. You can always cash out into the dollar. The question is why should you want to? The US Government (Federal Reserve) has spent the last 20+ years inflating the national debt from 5.6 trillion to 28.4 trillion due to a variety of issues that have been “solved” by printing more money. Eventually those chickens come home to roost and the US dollar will lose its purchasing power which is what we are seeing currently with inflation. Do things actually cost more or is the dollar we use to pay for things worth less??? That’s a different conversation altogether but my point is the option to convert your crypto to the dollar is always there.

I think you’ve honed in on the biggest hurdle for most people regarding crypto and that is the propensity to just write it off as a fad or something foolish that people are throwing their money into. The biggest detractor for people in my experience seems to be they have a hard time grasping the “well what is it though” as if they want it to be something tangible – something they can physically hold. My response usually goes something like this… “Do you get direct deposit? Do you pay your bills online? Do you buy stuff from Amazon? At any point during those transactions do you physically hold that currency that you receive/spend? No? Well how is that digital form of money any different than crypto currency?” At that point I typically see the light bulbs kind of go on. With crypto if your question is “ok how can I turn this into real money”… well the option to turn it into the US dollar is always there. You can always cash out into the dollar. The question is why should you want to? The US Government (Federal Reserve) has spent the last 20+ years inflating the national debt from 5.6 trillion to 28.4 trillion due to a variety of issues that have been “solved” by printing more money. Eventually those chickens come home to roost and the US dollar will lose its purchasing power which is what we are seeing currently with inflation. Do things actually cost more or is the dollar we use to pay for things worth less??? That’s a different conversation altogether but my point is the option to convert your crypto to the dollar is always there.

![]() Just about every new technology has started out as a “fad”. Personal computers, the internet, E-mail…you can easily find “experts” out there at the time that said these things had no staying power. All great points you bring up, we’ve been using “digital currency” for years without ever batting an eye at it. Now all this technology comes out with the word “CRYPTO” in it and people’s first instinct is to be hesitant. I think there’s a few reasons for that hesitancy. Obviously one being the newness of the technology. Another being some of the verbiage that’s used. I think “coins” is a misleading term that’s used amongst the crypto community. I tell people that each “coin” is a form of technology that you’re investing in, some are huge ideas that could transform the world…other’s are micro ideas that work within certain platforms. I’d be lying if I said I could explain all this technology in layman’s terms for people to understand, so why don’t we go through some of the common terms used and questions asked and you can give people a little explanation on what this technology means, and how it plays out in the real world and essentially in their lives now and in the future.

Just about every new technology has started out as a “fad”. Personal computers, the internet, E-mail…you can easily find “experts” out there at the time that said these things had no staying power. All great points you bring up, we’ve been using “digital currency” for years without ever batting an eye at it. Now all this technology comes out with the word “CRYPTO” in it and people’s first instinct is to be hesitant. I think there’s a few reasons for that hesitancy. Obviously one being the newness of the technology. Another being some of the verbiage that’s used. I think “coins” is a misleading term that’s used amongst the crypto community. I tell people that each “coin” is a form of technology that you’re investing in, some are huge ideas that could transform the world…other’s are micro ideas that work within certain platforms. I’d be lying if I said I could explain all this technology in layman’s terms for people to understand, so why don’t we go through some of the common terms used and questions asked and you can give people a little explanation on what this technology means, and how it plays out in the real world and essentially in their lives now and in the future.

![]() Blockchain in its simplest form is just blocks of data/info that are stored in chronological order which make it difficult/impossible to change or alter. If there is ever any question about a transaction or piece of information it can always be retrieved on the blockchain and the information is unable to be altered.

Blockchain in its simplest form is just blocks of data/info that are stored in chronological order which make it difficult/impossible to change or alter. If there is ever any question about a transaction or piece of information it can always be retrieved on the blockchain and the information is unable to be altered.

![]() You are like a crypto dictionary…as you grabbed them from crypto dictionary dot com or some shit haha. If one really looks into the true real world use cases of some of this technology, it’s easy to see how so many areas of employment are going to be affected, positively and negatively by these technologies. I told my lawyer buddy/client to look into investing into Ethereum as it will make part of his areas of practice useless in the future. I say that jokingly because I don’t know if that’s fully true, but common sense tells me if so much of every day processes we have to go through “paperwork” wise, get built into basic every day technology, then certain jobs aren’t going to be necessary anymore…am I correct in that thinking? De-Fi and Smart Contracts cut into what, 90% of what banks do?

You are like a crypto dictionary…as you grabbed them from crypto dictionary dot com or some shit haha. If one really looks into the true real world use cases of some of this technology, it’s easy to see how so many areas of employment are going to be affected, positively and negatively by these technologies. I told my lawyer buddy/client to look into investing into Ethereum as it will make part of his areas of practice useless in the future. I say that jokingly because I don’t know if that’s fully true, but common sense tells me if so much of every day processes we have to go through “paperwork” wise, get built into basic every day technology, then certain jobs aren’t going to be necessary anymore…am I correct in that thinking? De-Fi and Smart Contracts cut into what, 90% of what banks do?

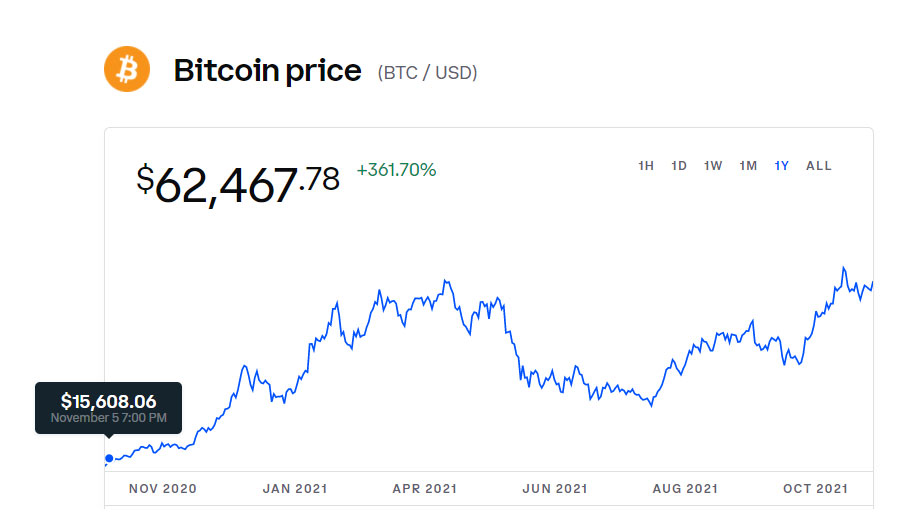

Below this paragraph are 1 year charts of some of the cryptocurrencies referenced.

![]() I think De-Fi and Smart contracts have the ability to streamline a lot of the mundane and archaic way of doing things. I think it will take a long time for people to fully rely on a smart contract so they will still look to traditional financial institutions as it is generally more comfortable to deal with. I think those same institutions will utilize the tech and make their own work a lot faster / easier but at the same time they will find a way to profit off of it rest assured.

I think De-Fi and Smart contracts have the ability to streamline a lot of the mundane and archaic way of doing things. I think it will take a long time for people to fully rely on a smart contract so they will still look to traditional financial institutions as it is generally more comfortable to deal with. I think those same institutions will utilize the tech and make their own work a lot faster / easier but at the same time they will find a way to profit off of it rest assured.

Thanks so much to Jim for taking the time to better explain for some of the newbies out there how to best start investing. If you guys know Jim, reach out to him and he can help you get going and probably hit you up with some referral links. Same goes for 3Zero followers, hit me up and I’ll help you get started.

Thanks everyone!

When it was time to decide on a college I picked RIT to pursue a major in Illustration, concentrating in graphic design, animation and creative writing. I visited RIT with my parents at the end of my junior year in High School and I immediately knew I wanted to go there. It was one of those moments where as soon as I saw the school I knew it was the place for me; there was an instant connection. I applied for early action and was accepted in December of 2004.

When it was time to decide on a college I picked RIT to pursue a major in Illustration, concentrating in graphic design, animation and creative writing. I visited RIT with my parents at the end of my junior year in High School and I immediately knew I wanted to go there. It was one of those moments where as soon as I saw the school I knew it was the place for me; there was an instant connection. I applied for early action and was accepted in December of 2004. Being a stay at home mom and a business owner is a lot…you have to find a balance between getting your work done and being there for your kids. It was a lot harder when they were 1ish because there were less naps, still nursing and diapers. I would say work above the hard times, do what you can when you can without sacrificing your family’s happiness. I’ve changed my schedule many times. I’m not a morning person, so at first when my oldest was little I would put her to bed and then work until 12-1 in the morning and then take a nap when she took her first nap. Now though I have to get my kids to school so my schedule has changed to working in the mornings before my kids get home, so when they are home I can focus on being there for them. It’s about being flexible, working with how you feel at the moment, giving the attention where it needs it. Also reach out to other business owners, talk to them, become friends with them because the friendship and support I’ve had from you since I started out helped me more than you probably know.

Being a stay at home mom and a business owner is a lot…you have to find a balance between getting your work done and being there for your kids. It was a lot harder when they were 1ish because there were less naps, still nursing and diapers. I would say work above the hard times, do what you can when you can without sacrificing your family’s happiness. I’ve changed my schedule many times. I’m not a morning person, so at first when my oldest was little I would put her to bed and then work until 12-1 in the morning and then take a nap when she took her first nap. Now though I have to get my kids to school so my schedule has changed to working in the mornings before my kids get home, so when they are home I can focus on being there for them. It’s about being flexible, working with how you feel at the moment, giving the attention where it needs it. Also reach out to other business owners, talk to them, become friends with them because the friendship and support I’ve had from you since I started out helped me more than you probably know.

Lincoln’s Angels Inc

Lincoln’s Angels Inc

It was not long after Lincoln passed that my mother discovered the OWLET sock. This is a sock that monitors a baby’s heart rate and oxygen levels and alerts you when levels drop. I decided that was it. I could donate those socks to families in need. Families who could not afford one. Families who had lost a child and were now expecting another one. I can only imagine the anxiety that brings.

It was not long after Lincoln passed that my mother discovered the OWLET sock. This is a sock that monitors a baby’s heart rate and oxygen levels and alerts you when levels drop. I decided that was it. I could donate those socks to families in need. Families who could not afford one. Families who had lost a child and were now expecting another one. I can only imagine the anxiety that brings.

The 2 weeks before the tournament are the craziest. I am going everywhere to pick up baskets, but together goodie bags for the golfers, cellophane all the baskets, getting hole sponsorship signs printed, getting logos to our printer for our banners and setting up for the tournament the day ahead. Overall I probably put over 100 hours into the golf tournament. Is it worth it? ABSOLUTELY!!! Everyone has a great time and we raise alot of money between our teams paying to play, 50/50, basket raffles, merchandise sold day of and the lemonade stand. We have done 3 tournaments so far and in total between all 3 years we have raised over $20K for our organization!

The 2 weeks before the tournament are the craziest. I am going everywhere to pick up baskets, but together goodie bags for the golfers, cellophane all the baskets, getting hole sponsorship signs printed, getting logos to our printer for our banners and setting up for the tournament the day ahead. Overall I probably put over 100 hours into the golf tournament. Is it worth it? ABSOLUTELY!!! Everyone has a great time and we raise alot of money between our teams paying to play, 50/50, basket raffles, merchandise sold day of and the lemonade stand. We have done 3 tournaments so far and in total between all 3 years we have raised over $20K for our organization!

as well! That journey came as my “pivot” when the pandemic temporarily shut down travel and I needed to find a way to sustain my overhead and keep myself sane. I am technically trained and hold a Bachelor’s Degree in Fine Art but before this year, I would simply paint to fill my empty walls. Whenever friends or family would see my artwork, they would ask when I was going to start selling it. My answer was always that I was too busy I didn’t have enough hours in the day (as any fellow entrepreneur can relate to). Well, as you may have heard time and time again, life is too damn short, so I took a really difficult time and tried to find an opportunity in it. Travel is coming back now and I’m so grateful but as a result of the insanity that was 2020, I also see how important it is to diversify your streams of income because someday the rug can be swept from under you and you’ll need to flex to survive. Just one of life’s many lessons I hold near and dear!

as well! That journey came as my “pivot” when the pandemic temporarily shut down travel and I needed to find a way to sustain my overhead and keep myself sane. I am technically trained and hold a Bachelor’s Degree in Fine Art but before this year, I would simply paint to fill my empty walls. Whenever friends or family would see my artwork, they would ask when I was going to start selling it. My answer was always that I was too busy I didn’t have enough hours in the day (as any fellow entrepreneur can relate to). Well, as you may have heard time and time again, life is too damn short, so I took a really difficult time and tried to find an opportunity in it. Travel is coming back now and I’m so grateful but as a result of the insanity that was 2020, I also see how important it is to diversify your streams of income because someday the rug can be swept from under you and you’ll need to flex to survive. Just one of life’s many lessons I hold near and dear!